Auto loan insurance -

protection for you and your bank

Protect your vehicle and reduce financial risks with auto loan insurance.

What is auto loan insurance?

How it works?

Get an insurance policy

Make an insurance contract for a car purchased on credit to protect it from unforeseen circumstances

Provide bank protection

The policy reduces risks for the bank and allows you to avoid financial losses

Get compensation

The insurance company provides compensation in the event of loss or damage

Benefits for the bank

Benefits for Borrower

Risks we cover

Car loss

Vehicle damage

Failure to fulfill obligations

What to do if something happens?

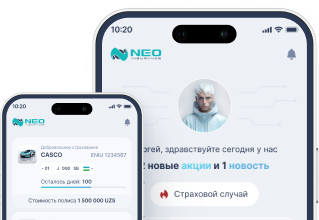

Within 3 days, inform us about the insurance event through the Neo Mobile app or call us on the number 71 202 55 66

Prepare and provide the necessary documents (for example, a policy, an accident certificate, a certificate from the PD).

Wait for the insurance company to assess the damage

Receive compensation, which will be sent either to you or directly to the bank